Hey trader!

If you’re reading this, chances are you’re curious about using AI to make smarter stock trading decisions. Maybe you’re tired of guessing the market or scrolling through endless financial news.

Don’t worry, I’ve got you covered.

Let’s sit down together (virtually!) and explore how AI-powered stock trading apps in India are changing the game.

But before this let’s understand 👇

Why should you use AI for stock trading?

Let me start with a simple question.

How many times have you sold a stock just because of emotions?

Or should I say… how often have you held a stock hoping it would bounce back?

Many times, right? I know, because I invest too, and I’ve gone through all of this while trading.

Now, how would you feel if I told you that from now on, all your trading decisions could be backed by powerful algorithms? These algorithms analyze patterns, news, and data 24/7, literally everything but without emotion.

Hard to believe? I thought the same at first. But it’s true.

All credit goes to AI and its application in stock trading. It has made investing so much easier that even a newbie can start analyzing charts and trends with AI’s help.

No matter whether you’re new to investing or already an active trader, these AI tools can improve your productivity and helps by:

- Analyzing historical data and spotting patterns

- Scanning news and tracking market sentiment

- Predicting stock movements based on real-time inputs

- Automating trades at just the right moment

Plus, AI tools help reduce human error and emotional bias, something every trader has struggled with at some point (including me).

Key features you should look for in an AI trading app

Before we dive into the best AI apps out there, let’s quickly check what really matters when picking one:

- Does the app give you real-time predictions, alerts, and helpful tips?

- Can it place trades for you automatically based on rules you set?

- Is the platform SEBI-registered and does it keep your data secure with strong encryption?

- Is it simple enough for beginners but powerful enough for experienced traders?

- Does it work smoothly with Indian stock exchanges like NSE and BSE?

Keep these points in mind, and you’ll be off to a great start!

Top AI stock trading apps in India (2025 list)

Let’s see some of the most trusted and feature-rich AI stock trading apps in India that you can explore:

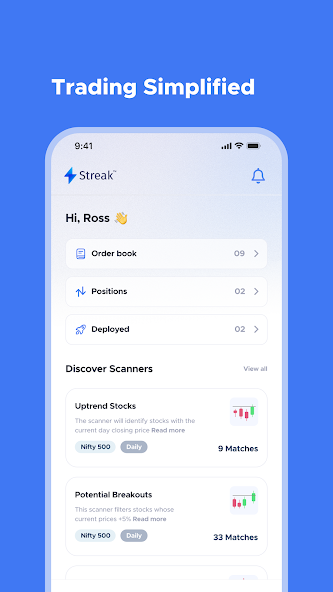

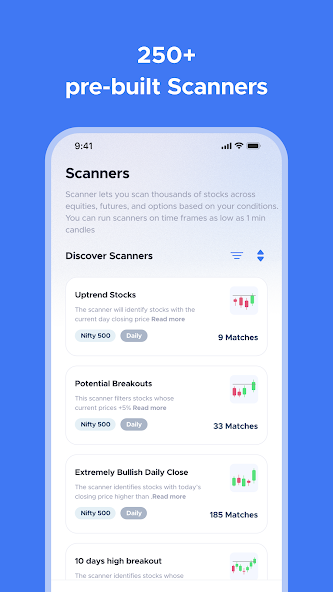

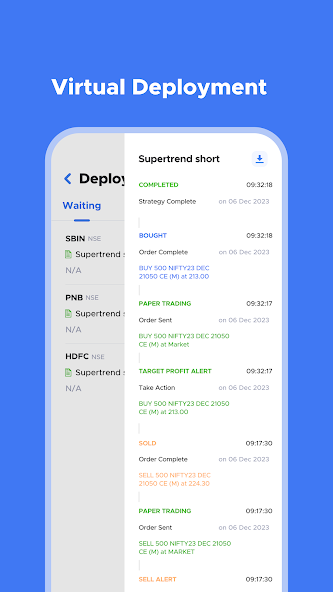

Zerodha Streak

Talking about stock trading in India and not mentioning Zerodha? Almost impossible.

Nithin Kamath and his team have truly changed the game for retail investors. And with Zerodha Streak, they’ve taken it a step further.

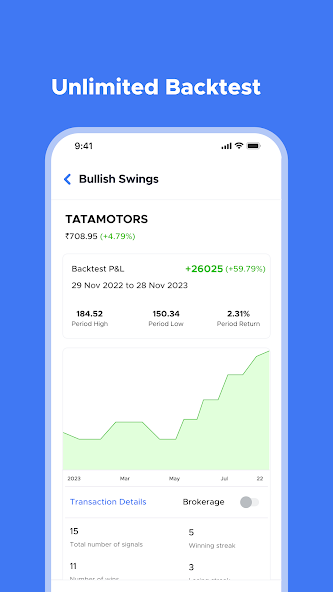

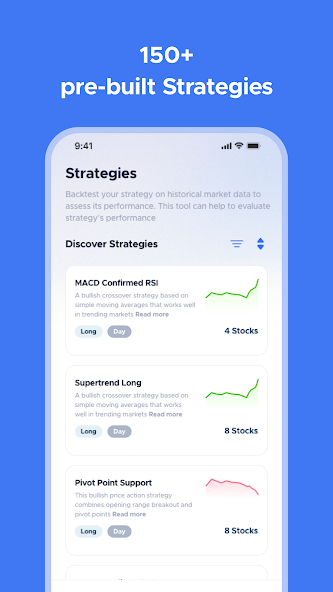

It’s a favorite among Indian traders who want smart strategy-building without the coding headache. You can easily create, backtest, and deploy your trading ideas using AI-powered logic and real-time market data.

And the best part is it’s fully integrated with the Zerodha account and you don’t need to switch platforms. Just analyze, test, and trade smarter, right from the same dashboard.

Pros

✔️ Easy-to-use strategy builder

✔️ No coding needed

✔️ Backtests your strategy in seconds

✔️ Works easily with Zerodha Kite

Cons

❌ Limited free backtests

❌ Only works with Zerodha account

Pricing

- Free plan available (limited features)

- Paid plans start at ₹500/month

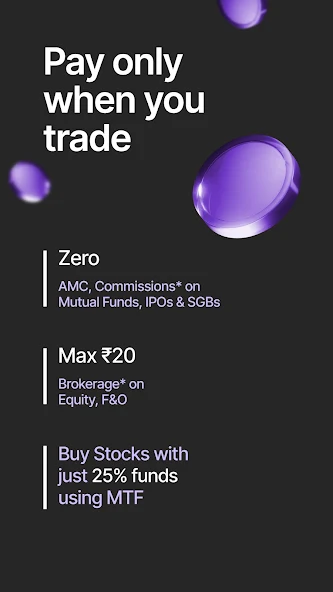

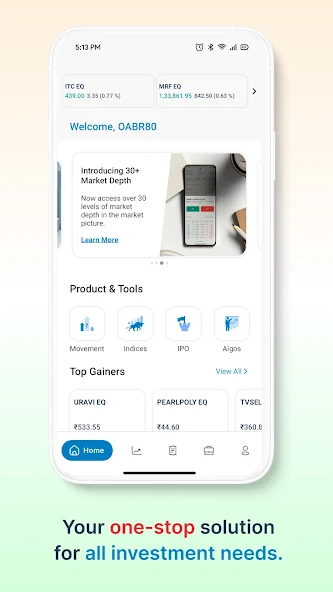

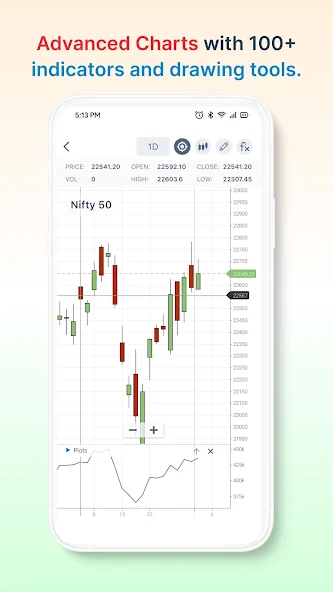

Upstox Pro

If you’ve been following Indian fintech for a while, you’ve probably heard of Ravi Kumar and Kavitha Subramanian, the minds behind Upstox. They’ve built a platform that’s all about speed, simplicity, and smart trading and Upstox Pro is a reflection of that vision.

This app is packed with powerful charting tools, real-time data, and AI-assisted insights that help you make faster, smarter decisions. You can set rules, and spot patterns without second-guessing every move.

Whether you’re tracking Nifty movements or eyeing that breakout stock, it helps you act with clarity, not confusion.

And guess what? It’s SEBI-compliant and built for Indian markets. So you can trade confidently, knowing you’re in good hands.

Pros

✔️ Fast charts with 100+ indicators

✔️ Clean, beginner-friendly UI

✔️ Real-time market data

✔️ Backed by a trusted Indian broker

Cons

❌ Limited AI-based decision-making

❌ No advanced automation like Streak

Pricing

- Upstox Pro is a free platform available to all Upstox clients with an active trading account.

5Paisa Auto Investor

What if your app could suggest the right mix of stocks or mutual funds based on your goals?

Well, 5Paisa does exactly that. It’s a budget-friendly trading platform backed by the legacy of the IIFL group.

They’ve launched the Auto Investor feature where an AI-based tool takes the heavy thinking off your shoulders. It recommends ready-made investment plans based on your financial goals, risk appetite, and current market trends. You don’t have to be a market expert, just pick a plan, and the AI does the rest.

For example,

Let’s say your goal is wealth creation, retirement planning, or saving on taxes. You simply tell Auto Investor what you’re aiming for, and it suggests a personalized portfolio using AI. It even keeps things in check by rebalancing when the market shifts.

Whether you’re planning long-term or just dipping your toes in, Auto Investor gives you that much-needed confidence without overwhelming you with charts, stress, or market noise.

Pros

✔️ Great for first-time investors

✔️ Automated portfolios based on risk profile

✔️ Integration with mutual funds and stocks

✔️ SEBI-registered platform

Cons

❌ Limited control over individual trades

❌ Might feel restrictive for active traders

Pricing

- Free to use

- Brokerage plans start at ₹20 per trade (Power Investor plan)

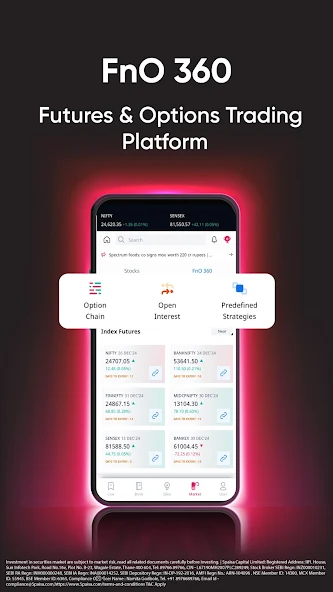

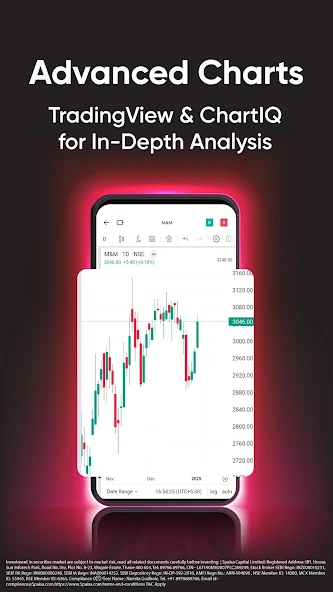

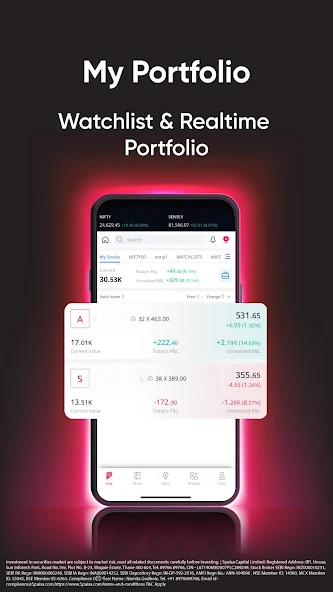

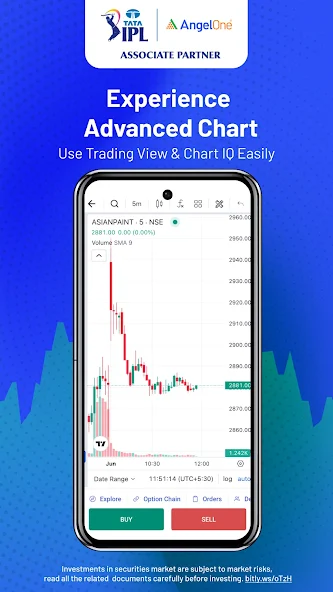

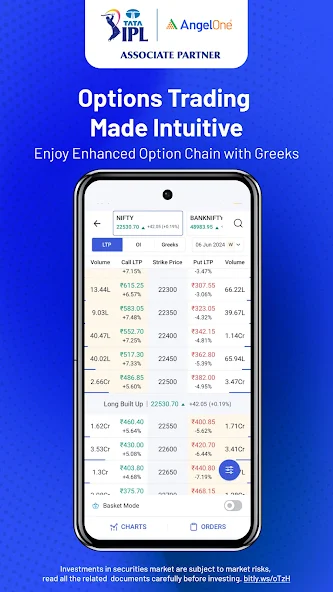

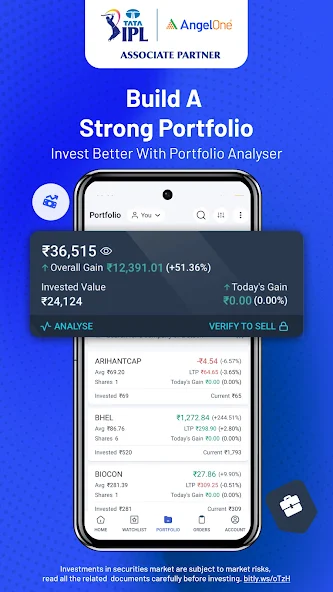

Angel One SmartAPI

Want to take your trading game to the next level with automation? Or dreaming of building your own trading bot?

Angel One SmartAPI can be the one you’re looking for.

It gives you the tools to connect AI models, create logic-based trading strategies, and automate your trades, just like the pros do.

This one’s definitely for the more tech-savvy crowd or fintech developers who love getting hands-on. But if that sounds like your vibe, SmartAPI is a total powerhouse.

And yes, it’s built for Indian markets, fully SEBI-regulated, and trusted by thousands of active traders.

Pros

✔️ Excellent for coders and tech-savvy traders

✔️ Build custom trading bots

✔️ Free SmartAPI access

✔️ Supports Python, Java, etc.

Cons

❌ Not beginner-friendly

❌ Requires tech knowledge

Pricing

- Free API access

- Standard brokerage charges apply

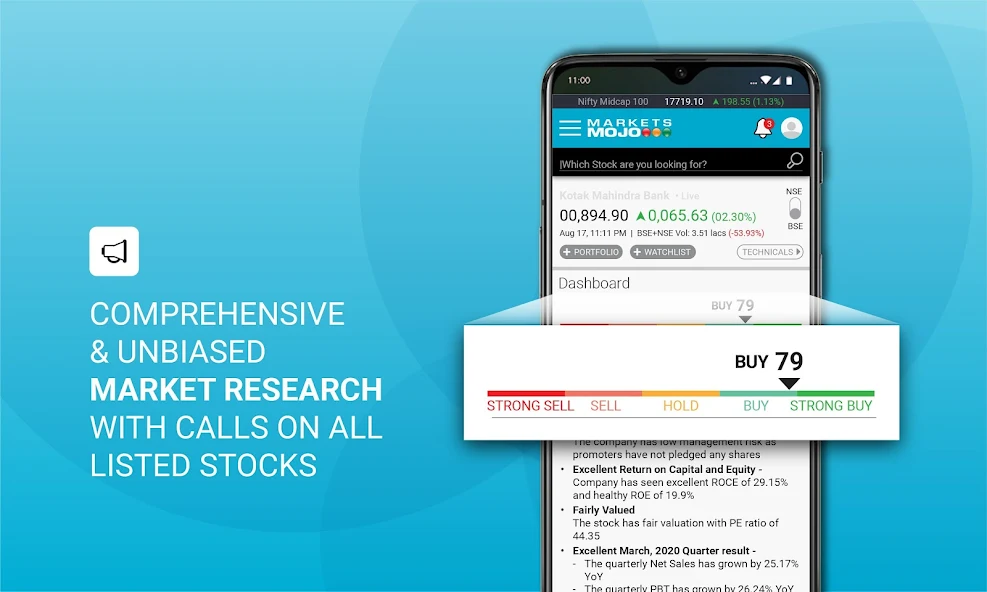

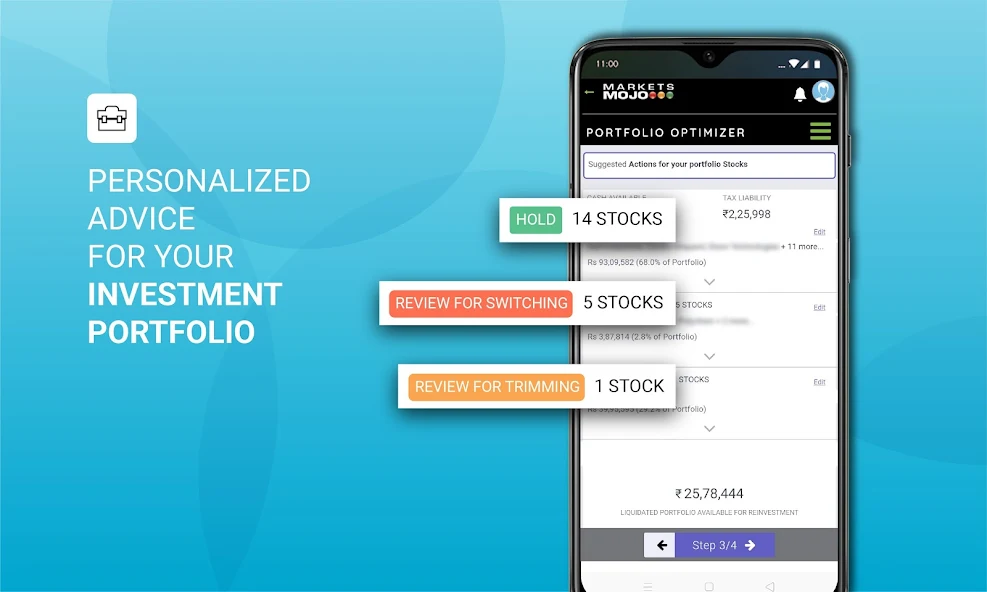

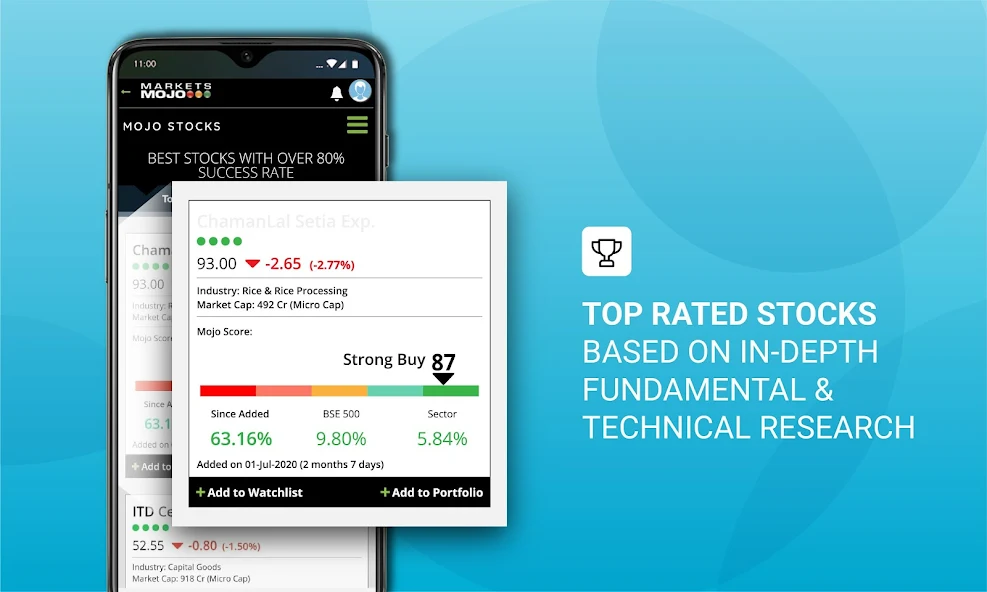

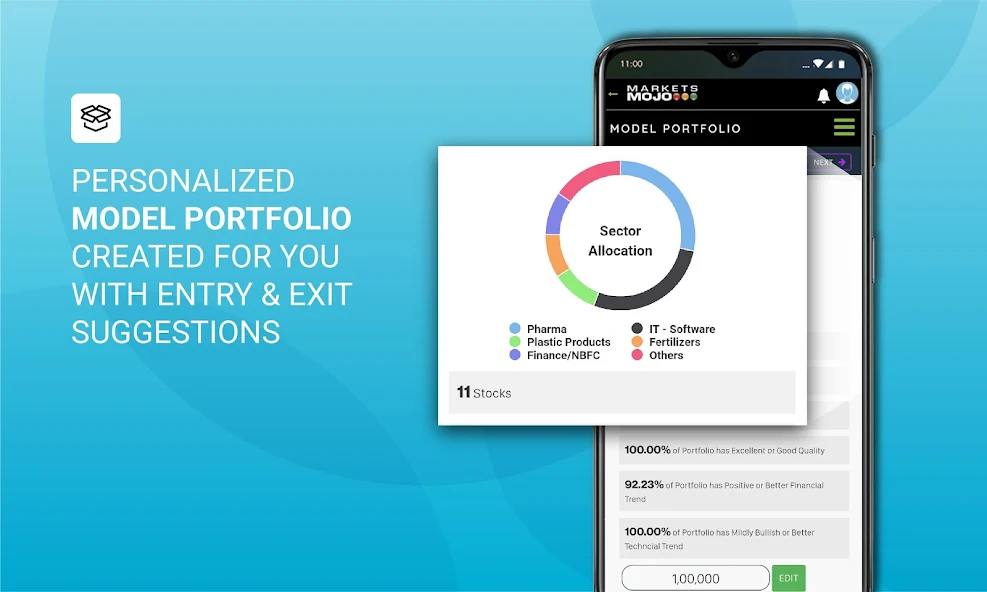

MarketsMojo

Have you ever placed a trade just because a friend gave you a tip?

Well, MarketsMojo is like that smart friend. But instead of brain cells, it runs on powerful AI.

It offers 360-degree stock analysis using AI, covering everything from fundamentals to future growth, financials, technicals, and even broker recommendations.

It dives deep into over 4,000 Indian stocks and gives each one a Mojo score based on fundamentals, valuations, financial trends, and technicals. You don’t need to be a market pro, just follow the color-coded insights and easy-to-understand recommendations.

Plus, it’s SEBI-compliant and built specifically for Indian investors. So whether you’re hunting for long-term winners or short-term movers, MarketsMojo gives you that extra edge, without any guesswork.

Pros

✔️ In-depth stock analysis with AI scores

✔️ Easy to understand for retail investors

✔️ Covers over 4,000 Indian stocks

✔️ Mojo Stocks feature is unique

Cons

❌ No direct trading

❌ Slightly cluttered dashboard

Pricing

- Free version available

- Premium plan starts at ₹999/month

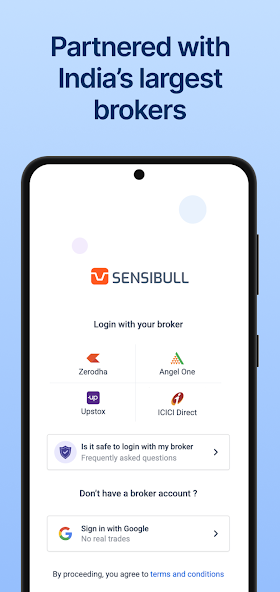

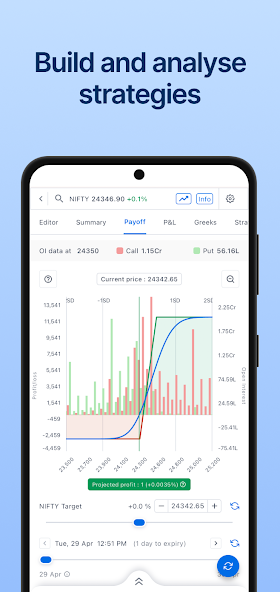

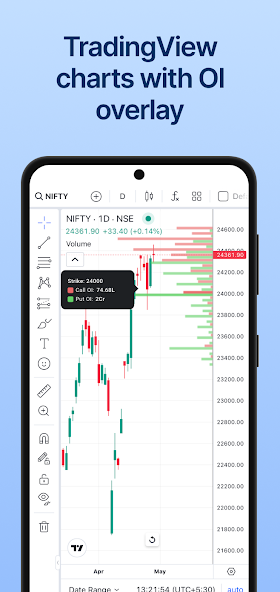

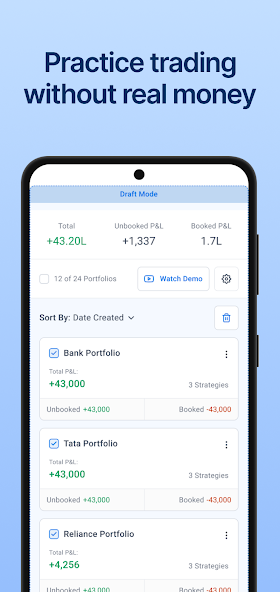

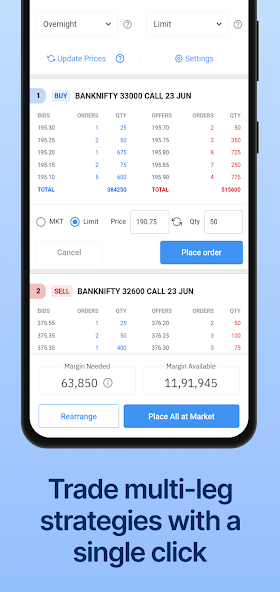

Sensibull

Are you interested in option trading? Or does option trading sound tricky to you?

Well, Sensibull makes it way simpler and smarter.

It’s an AI-powered stock trading platform built to simplify options trading for Indian investors. Whether you’re a beginner or a seasoned trader, Sensibull helps you find the best options strategies based on your market view and risk appetite.

You can think of it as your personal options coach which suggests strategies, shows potential profits and losses, and even helps you place orders.

And yes it’s built for the Indian market, fully SEBI-compliant, and helps you trade options with confidence, not guesswork. If you want to add options to your trading toolkit, Sensibull’s a great place to start.

Pros

✔️ Customized for options traders

✔️ AI-powered strategy suggestions

✔️ Risk analysis tools

✔️ Works with Zerodha, Upstox, etc.

Cons

❌ Mostly for derivatives, not equity

❌ Hard to learn for beginners, but not impossible

Pricing

- Free plan available

- Pro plans start at ₹800/month

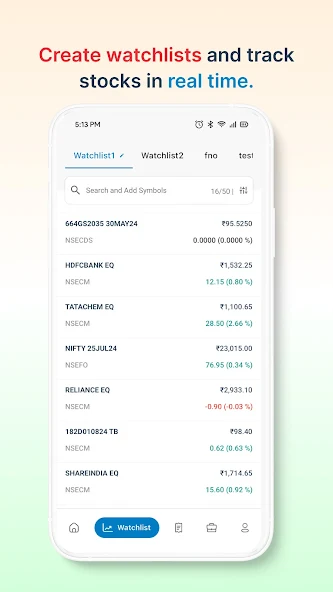

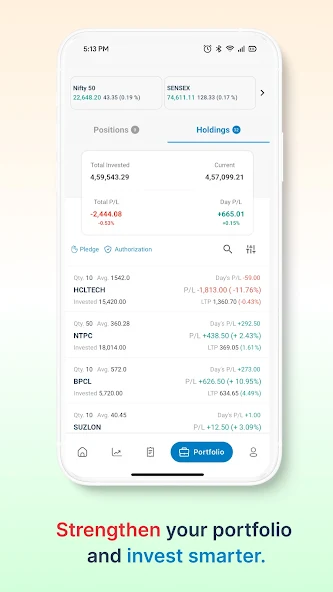

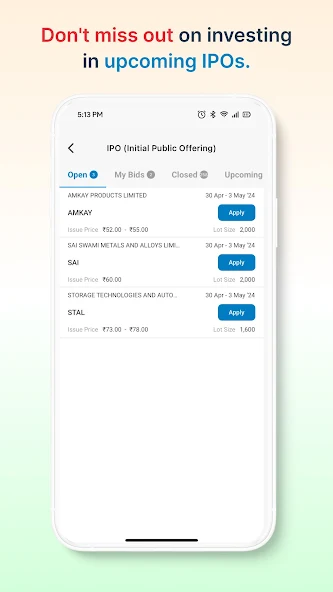

Share India

Share India brings a homegrown advantage to AI stock trading. Backed by SEBI registration and years of experience in Indian markets, this platform blends traditional brokerage services with modern AI technology.

What sets it apart is its focus on the Indian stock ecosystem, from equity to derivatives and algo trading. The AI tools offered by Share India help in analyzing market trends, managing risk, and executing trades with precision.

It also supports customizable trading algorithms that let you automate strategies based on your own rules, without writing a single line of code.

Pros

✔️ Offers algo trading for intraday

✔️ SEBI-registered with a strong brokerage base

✔️ AI-based signals for quick trades

✔️ Good for advanced Indian traders

Cons

❌ Not widely known among retail investors

❌ Website/app experience could be smoother

Pricing

- Custom pricing for algo trading

- Requires opening an account

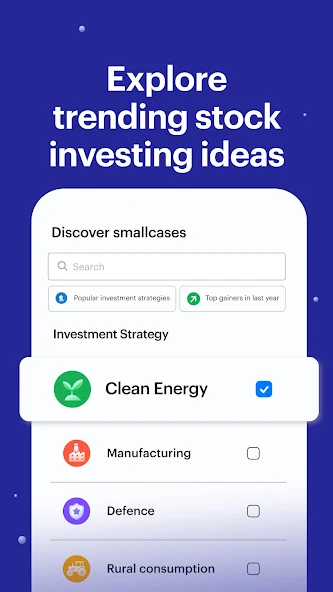

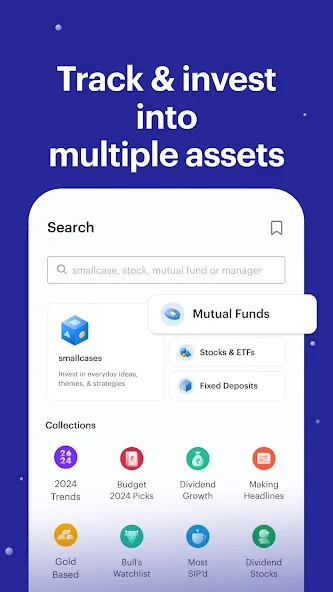

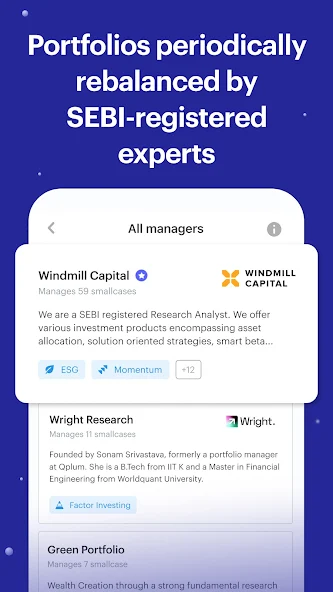

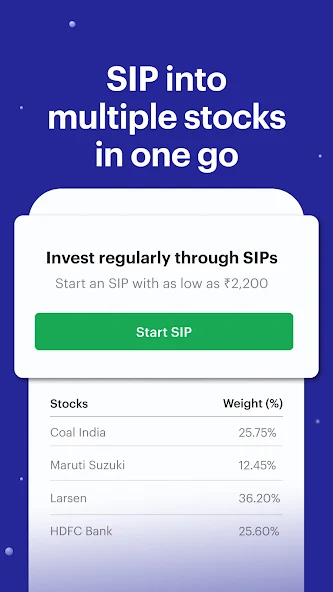

Smallcase

Now this one isn’t fully AI-powered, but let me tell you, it’s smart.

If you’re looking for a way to invest in ready-made portfolios instead of picking individual stocks.

Smallcase has got you covered. It offers curated, theme-based portfolios powered by AI and market research, so you can invest in ideas like “Electric Vehicles,” “Dividend Kings,” or “Rising Rural Demand” with just a few clicks.

It’s perfect for beginners and busy investors who want to build a diversified portfolio without the hassle of constant monitoring.

Plus, Smallcase works easily with India’s top brokers and follows all SEBI regulations, giving you peace of mind while you grow your money.

Pros

✔️ Invest in expert-curated portfolios

✔️ Easy for beginners

✔️ SEBI-regulated platforms

✔️ Thematic investing (like EV, IT, etc.)

Cons

❌ Can’t customize portfolios deeply

❌ Tracking error in some cases

Pricing

- Free access

- Charges apply only during stock purchase via broker

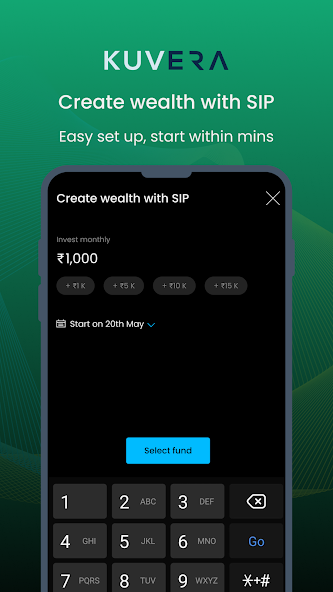

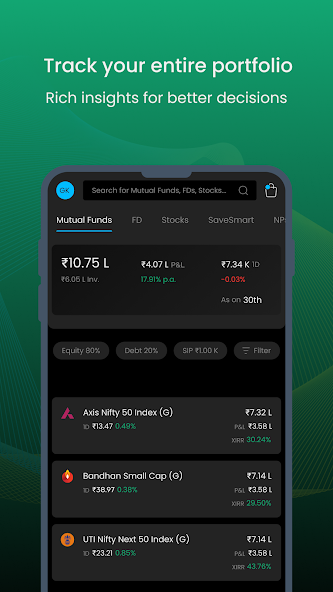

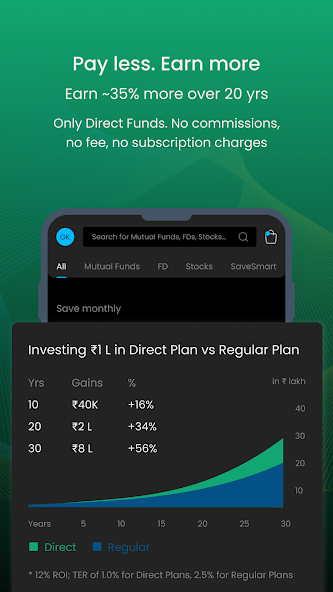

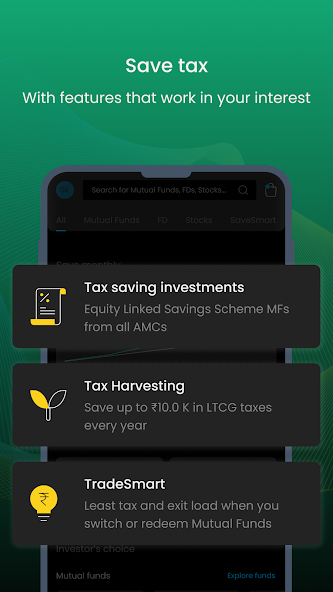

Kuvera

If mutual funds are your thing, Kuvera is the quiet genius in the room.

It uses AI to suggest funds based on your financial goals and risk tolerance. You can even get automated rebalancing suggestions and tax-harvesting strategies.

No commissions. No hard-selling. Just smart goal-based investing.

And the app is designed super user-friendly. Means you don’t get any confusing charts or jargon. Just clear advice and tools to help you track your investments and grow your wealth over time.

Plus, Kuvera is SEBI-registered, so you know your money is in safe hands.

Pros

✔️ 100% free direct mutual fund investing

✔️ Smart recommendations using AI

✔️ No commissions

✔️ Goal-based investing

Cons

❌ Not suitable for active traders

❌ Limited stock trading tools

Pricing

- Completely free

- Earns via advisory services, not commissions

Quick comparison of top AI stock trading apps in India

| App Name | AI Features | Best For | SEBI Registered | Platform |

| Zerodha Streak | Algo trading, backtesting, custom strategies | Active traders | Yes | Web, Android |

| Upstox Pro | Predictive analytics, fast execution | Intermediate users | Yes | Android, iOS |

| 5Paisa Auto Investor | AI recommendations, automated SIPs | Beginners | Yes | Android, iOS |

| Angel One SmartAPI | Custom AI strategies, smart signals | Developers & coders | Yes | Web, Mobile |

| MarketsMojo | AI stock scoring, in-depth analysis | Long-term investors / Stock researchers | Yes | Web, Android |

| Sensibull | Options strategy builder with AI insights | Options traders | Yes | Web, Mobile |

| Share India | No-code algo trading, marketplace access | Algo + intraday | Yes | Web, iOS, Android |

| Smallcase | AI-curated themes & baskets | Thematic investors | Yes | Android, iOS |

| Kuvera | AI-assisted portfolio management | Mutual fund investors | Yes | Android, iOS |

Before ending, I want to answer one of the most common questions that might you’ve thought of once.

Is AI stock trading legal and safe in India?

Yes, AI stock trading is completely legal and safe in India, as long as you’re using SEBI-registered platforms. That’s why I’ve only included apps/software above that follow Indian market rules.

Always check for features like data encryption, two-factor authentication, and SEBI compliance badges on websites or app listings. These help keep your money and data secure.

And a gentle reminder: AI tools can help you make smarter decisions, but no tool guarantees profits. Always invest wisely, and don’t put in more than you can afford to lose.

The future of AI in Indian stock trading

AI is just getting started in India’s stock market, and it’s going to get even better over the next few years. Here’s what’s coming:

- Smarter robo-advisors that understand you better

- Real-time emotion and sentiment tracking to spot market mood swings

- Personalized AI assistants guiding your trades

- Integration with voice commands and even smart glasses

Sounds exciting, right?

Ready to let AI level up your trading?

AI is changing the way we trade and making it smarter, faster, and a bit less stressful.

So, whether you’re a newbie or a seasoned investor, these AI stock trading apps in India can help you trade smarter, faster, and with more confidence.

Just remember to pick one that suits your style, and make sure it’s safe and SEBI-compliant. Otherwise, they might just end up being the next QuantsAIS, who knows? 😅

Thanks for hanging out with me on this! If you found this blog useful, feel free to share it with your investor friends!

And for more cool AI tools and tips, don’t forget to check out Unrola! ✨